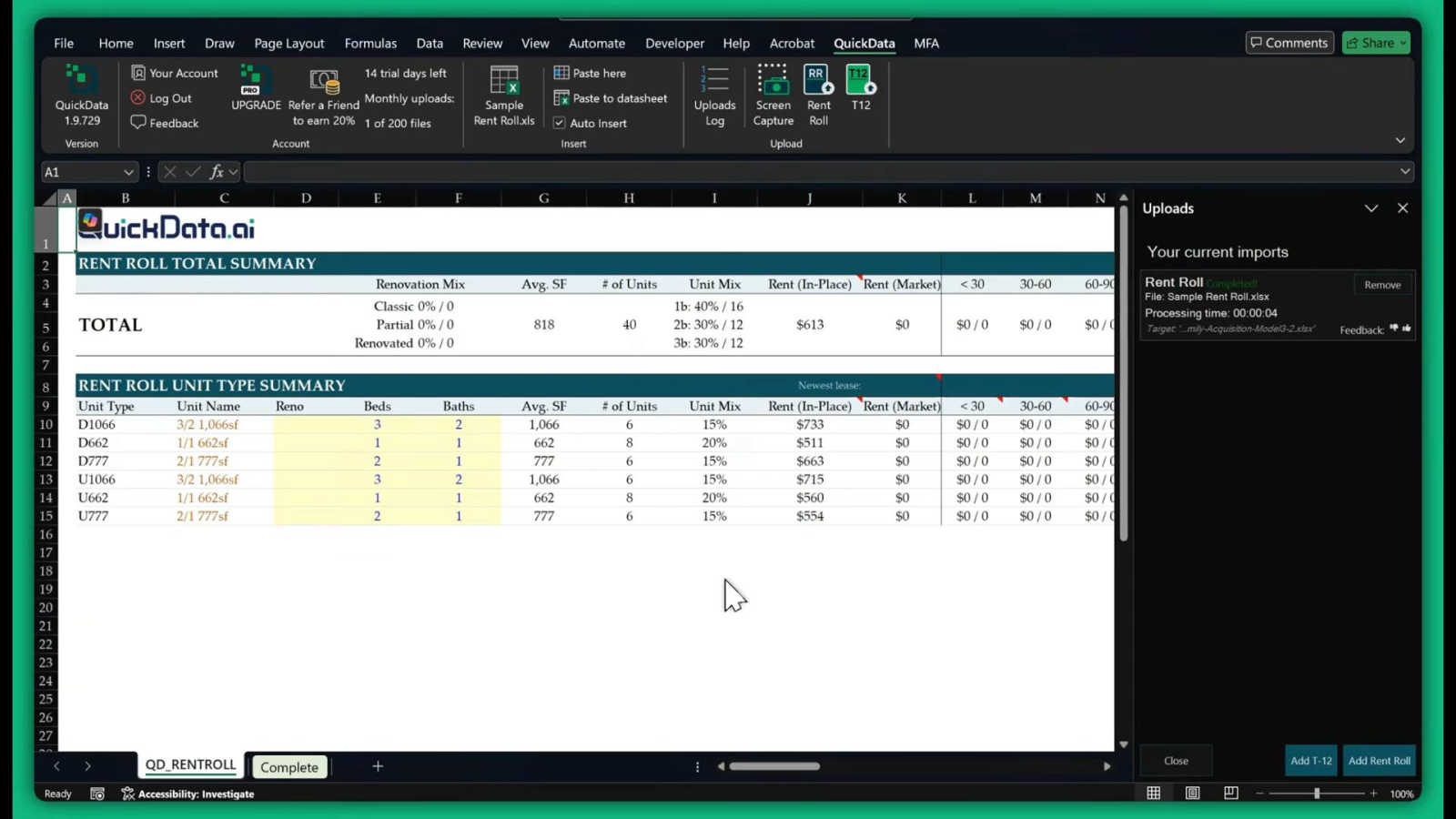

QuickData.ai

QuickData.ai automates multifamily rent roll and T12 data entry into Excel, saving underwriters 15 hours monthly.

Visit

About QuickData.ai

QuickData.ai represents a paradigm shift in multifamily real estate underwriting, moving the industry from tedious manual data entry to intelligent, automated analysis. At its core, it is a sophisticated Excel add-in powered by specialized artificial intelligence designed for the commercial real estate sector. The tool directly addresses one of the most time-consuming bottlenecks in deal analysis: extracting critical financial data from dense, unstructured documents like rent rolls, trailing twelve-month (T12) statements, and offering memorandums (OMs). By automating this process, QuickData.ai seamlessly populates existing Excel underwriting models with accurate, structured data in a fraction of the time. Its primary value proposition is not just speed—saving professionals an average of 15 hours per month—but also the elimination of human error and the capacity to analyze a higher volume of potential acquisitions with greater confidence. It is engineered specifically for acquisitions teams, commercial brokers, lenders, and accounting firms who require precision and efficiency in their financial modeling, enabling them to shift their focus from data transcription to strategic decision-making and deal evaluation.

Features of QuickData.ai

Automated Rent Roll Parsing

This feature utilizes advanced AI to meticulously scan and interpret complex rent roll PDFs or Excel files. It identifies and extracts unit-level details such as unit numbers, square footage, lease start and end dates, current rental rates, and tenant information. The AI is trained to recognize various formats and layouts, ensuring that even non-standard documents are processed accurately, transforming pages of dense data into a clean, organized dataset ready for your financial model in seconds.

Intelligent T12 Statement Extraction

QuickData.ai's AI engine is specifically calibrated to parse the nuanced financial data within T12 income statements. It automatically locates and extracts key line items including monthly rental income, other income sources, and operating expenses like utilities, repairs, and property management fees. This automation ensures that historical performance data is transferred flawlessly into your underwriting model, providing a reliable foundation for projections and analysis without manual transcription errors.

Seamless Excel Integration

The tool operates natively as an add-in within Microsoft Excel, requiring no complex data exports or switching between platforms. Processed data from PDFs or source Excel files is populated directly into your chosen worksheet cells, aligning with your existing model's structure. This deep integration means there is no need to learn a new software interface; professionals can continue using their trusted, customized underwriting templates while supercharging their data ingestion workflow.

One-Click Document Processing

Designed for maximum efficiency, QuickData.ai condenses the entire data extraction workflow into a simple, single action. After installing the add-in and selecting the target document, users can initiate the AI-powered parsing with one click. The system handles the rest—reading, interpreting, structuring, and inputting the data—dramatically reducing the steps required to go from a raw document to an analysis-ready model, enabling true "analyze in minutes" capability.

Use Cases of QuickData.ai

Accelerated Multifamily Acquisition Underwriting

Acquisitions analysts and associates can underwrite potential deals up to 10x faster. Instead of spending hours manually inputting data from a property's rent roll and T12, they use QuickData.ai to automate the process. This rapid turnaround allows teams to evaluate more deals in a competitive market, perform deeper sensitivity analyses, and make informed investment decisions with a significant time advantage.

Broker Deal Package Preparation and Analysis

Commercial real estate brokers preparing marketing packages or evaluating properties for clients can use QuickData.ai to quickly standardize and analyze financial data from various sources. By instantly extracting data into a consistent Excel format, brokers can efficiently create pro formas, benchmark properties, and provide data-backed insights to sellers or buyers, enhancing their advisory value and speeding up the transaction timeline.

Lender Due Diligence and Risk Assessment

Lenders and debt underwriters can streamline their due diligence process when evaluating loan applications for multifamily properties. QuickData.ai allows them to rapidly import and verify historical income and expense data from provided T12s and rent rolls directly into their credit analysis models. This improves underwriting accuracy, reduces processing time, and helps in more effectively assessing cash flow stability and property performance risks.

Accounting Firm Audit and Financial Review

Accounting firms servicing multifamily real estate clients can utilize the tool to automate the initial data gathering phase for audits, reviews, or tax preparation. Extracting data from client-provided financial documents into structured Excel formats reduces manual entry time for junior staff, minimizes data transfer errors, and allows senior accountants to focus on higher-level analysis, compliance checks, and strategic financial advice.

Frequently Asked Questions

What document formats does QuickData.ai support?

QuickData.ai is designed to process the most common document types used in real estate transactions. It fully supports PDF files, which are the standard format for rent rolls, T12s, and offering memorandums. Additionally, it can extract data from Excel source files. The AI is built to interpret various layouts and table structures within these formats, ensuring broad compatibility with documents from different property management software and brokers.

Does QuickData.ai work with my existing Excel underwriting model?

Yes, absolutely. A core design principle of QuickData.ai is seamless integration with your current workflow. It is an add-in that works within Excel itself. The extracted data can be mapped and output into the specific cells or sheets of your pre-existing, customized underwriting model. You do not need to adopt a proprietary template; you can continue using the model you have developed and trust.

How accurate is the AI data extraction?

QuickData.ai employs AI specifically trained on thousands of multifamily real estate documents, making it highly accurate at recognizing and extracting relevant financial data. While no automated system is 100% perfect, it significantly reduces human error associated with manual entry. The setup includes a free 1:1 onboarding session to help users understand the process, and it is always recommended to perform a quick sense-check on the imported data, which is far faster than manual entry from scratch.

Is there a free trial available?

Yes, QuickData.ai offers a full-featured 14-day free trial for new users. This trial allows you to test the software with your own documents and within your own Excel environment to experience the time savings and accuracy firsthand. You can request the trial directly from their website, and it includes setup assistance and a free onboarding session to ensure you get the most value from the tool during the trial period.

You may also like:

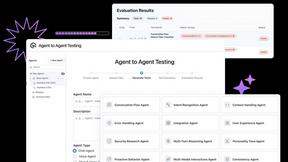

Agent to Agent Testing Platform

Agent-to-Agent Testing validates agent behavior across chat, voice, phone, and multimodal systems, detecting security and compliance risks.

Kane AI

KaneAI is a GenAI-native testing agent that helps teams plan, create, and evolve tests using natural language for fast, integrated quality engineering

QR Menu Ninja

QR Menu Ninja lets restaurants create fast, mobile-friendly QR code menus that are easy to update, share, and manage—no apps required.