Private Equity List

AI-powered platform finds private equity and venture capital investors to help you get funded.

Visit

About Private Equity List

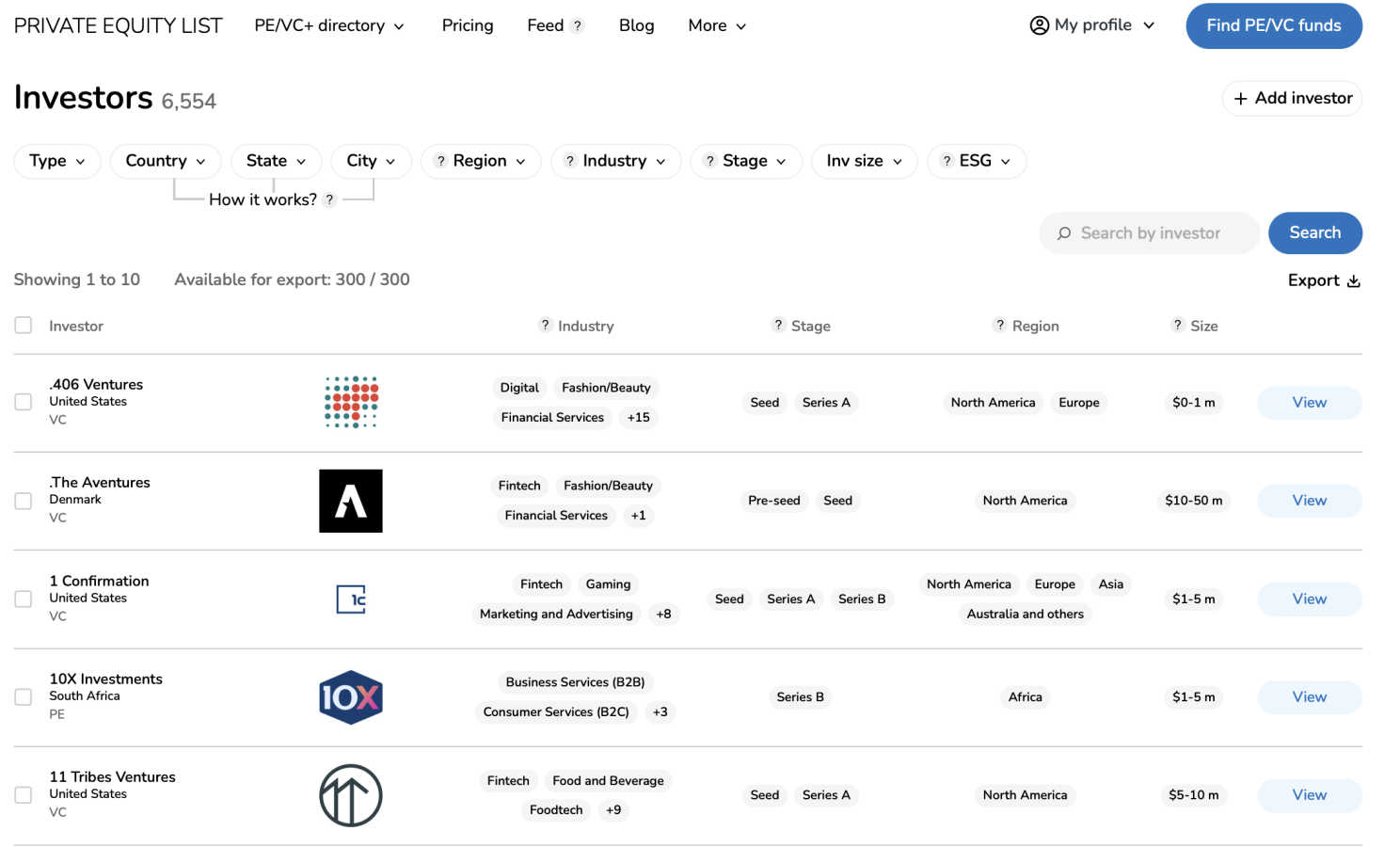

Private Equity List is a specialized database platform designed to demystify and streamline access to the private equity and venture capital landscape. It serves as a powerful, user-centric alternative to larger, more expensive platforms like Pitchbook and Crunchbase, focusing specifically on delivering actionable investor data. The platform aggregates detailed information on thousands of PE firms, VC funds, accelerators, and their investment teams globally. Its core value proposition is a combination of affordability, a super-intuitive interface, and a purpose-built feature set that cuts through the noise of generalist databases. With a recent major update introducing an AI Search function, users can now find investors using natural language queries, further accelerating the research process. It is trusted by over 10,300 users, including startup founders, consultants, investment professionals, and researchers, who rely on its human-curated, frequently updated data for critical tasks like fundraising, partnership sourcing, and market analysis.

Features of Private Equity List

AI-Powered Natural Language Search

This cutting-edge feature allows users to bypass complex filters and search the database using simple, conversational language. You can ask questions like "Find early-stage climate tech VCs in Europe" or "List Series A investors in fintech," and the AI will return targeted results. It's designed to mimic brainstorming with an expert, significantly reducing the time to generate a relevant investor shortlist, though users are advised to verify details for accuracy.

Super-Intuitive Search & Filter System

The platform is built around a seamless user experience with powerful, PE/VC-first filters. Users can drill down by critical criteria such as geographic focus, investment stage, check size, industry thesis, and fund status. This system is engineered to move users from a broad search to a highly targeted, actionable list of potential investors in just a few minutes, without the steep learning curve associated with enterprise-grade tools.

Comprehensive Investor Profiles & Contact Enrichment

Each fund profile is a rich repository of vital data, including fund details, investment focus, and portfolio companies. Crucially, Private Equity List provides direct access to contact information for investment team members, including roles and emails. This contact enrichment is available for bulk export, enabling efficient outreach campaigns without the exorbitant costs typically associated with acquiring such data.

Curated "New Funds" List & Export Functionality

The platform features a dedicated section for new PE/VC funds launched within the last 6-12 months, which are often more eager to deploy capital. This provides a competitive edge in discovering fresh opportunities. Furthermore, all search results and lists can be exported into structured, ready-to-use formats like CSV, allowing for easy integration into CRM systems, spreadsheets, and external workflows.

Use Cases of Private Equity List

Startup Fundraising

Founders at any stage, from pre-seed to Series C, can rapidly identify and qualify potential investors. By filtering for specific geographies, ticket sizes, and industry theses, startups can build a targeted outreach list in seconds, dramatically speeding up the capital-raising process and connecting with the most relevant funding partners for their growth.

Consultant & Advisor Deal Sourcing

Financial advisors, M&A consultants, and fundraising consultants use the platform to create precise buyer or investor shortlists for their clients. This enables them to execute on fundraising and M&A mandates more efficiently, secure success fees faster, and deliver high-value, data-driven strategic advice backed by comprehensive market intelligence.

VC Ecosystem Partnership Development

Existing venture capital funds, accelerators, and venture studios leverage the database to find co-investors and strategic partners across a network of over 7,000 funds. This helps in syndicating deals, providing better support for portfolio companies during subsequent funding rounds, and expanding their own network within the global investment community.

Academic & Market Research

Universities, journalists, government agencies, and independent researchers utilize Private Equity List as a reliable source for market analysis, trend reporting, and academic studies. The human-curated and frequently updated data provides a solid foundation for understanding investment flows, sector popularity, and the evolving landscape of private capital.

Frequently Asked Questions

What makes Private Equity List different from Pitchbook or Crunchbase?

Private Equity List is a specialized, lightweight alternative focused specifically on PE/VC investor data. It offers a more intuitive user experience, PE/VC-first filters, and direct contact enrichment at a significantly more affordable price point. It avoids the analytics overload and high enterprise pricing of larger platforms, providing best-in-class value for targeted investor search and list-building.

How accurate and current is the data on the platform?

The data is human-curated and updated nearly daily. The platform clearly displays the last database update date (e.g., "26 January, 2026") and tracks stats like new funds and contacts added. While the AI search is powerful, the platform transparently notes that it can make mistakes, encouraging users to verify key details for critical outreach.

Is there a free plan available?

Yes, Private Equity List offers a free tier that includes access to basic functions, allowing users to test the core search and filter capabilities. You can start using it without providing a credit card, making it easy to evaluate the platform's value before committing to a paid subscription.

Who are the typical users of Private Equity List?

The user base is diverse, encompassing startups of all stages, consultants and financial advisors, professionals within the VC ecosystem (funds, accelerators), and institutions like universities and research bodies. It is designed to be equally effective for solo founders and large corporate teams, providing scalable value across the board.

You may also like:

QR Menu Ninja

QR Menu Ninja lets restaurants create fast, mobile-friendly QR code menus that are easy to update, share, and manage—no apps required.

Beeslee AI Receptionist

Beeslee AI answers calls, books appointments, and captures leads for your business 24/7.

Golden Digital's Free D2C Marketing Tools

Free AI tools for D2C brands to audit stores and calculate profitable growth.