Chart

About Chart

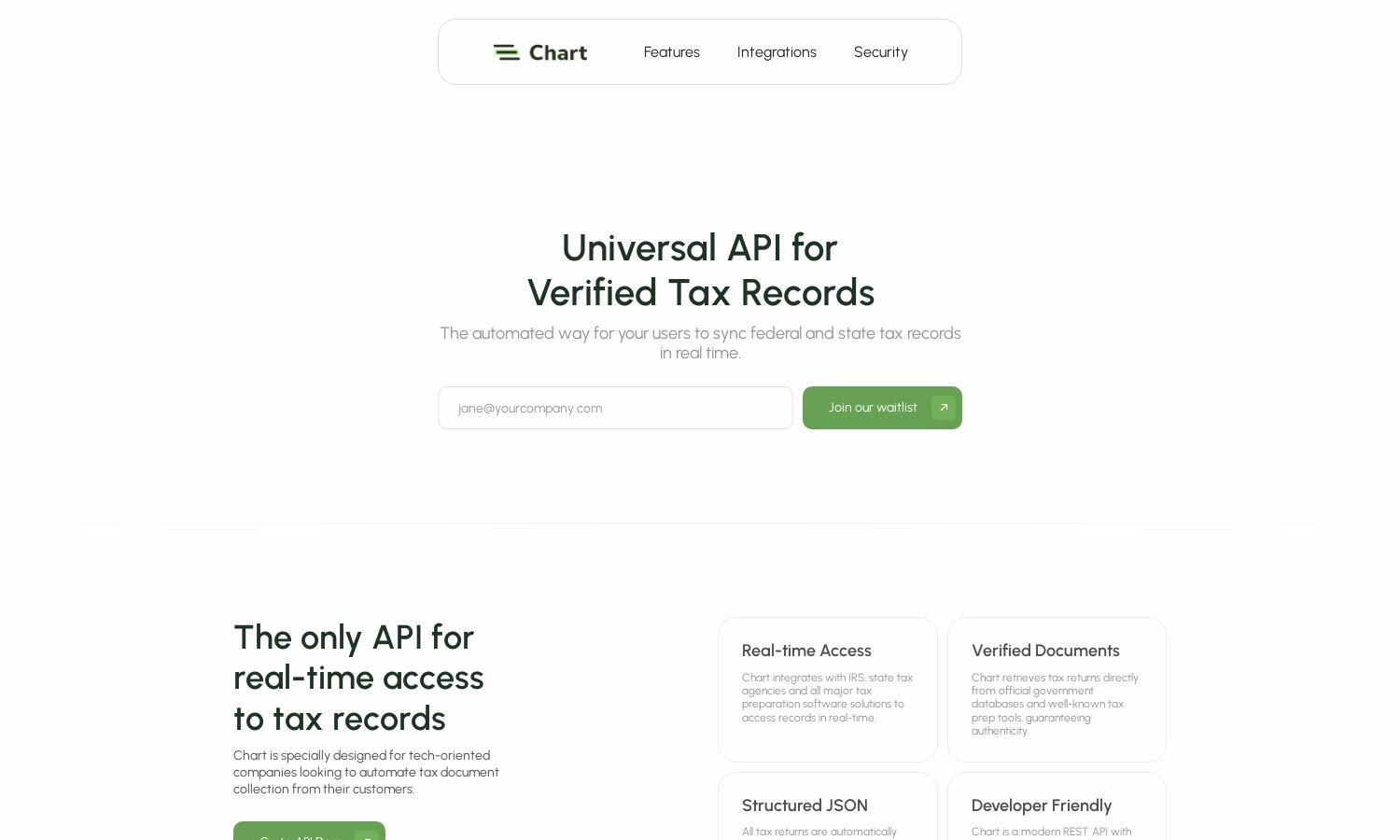

Chart is designed for tech-oriented companies seeking an automated solution for tax document collection. With real-time access to federal and state tax records through a universal API, users can easily sync verified documents. Chart’s innovative feature is its integration with major tax agencies, enhancing efficiency and accuracy.

Chart offers flexible pricing plans tailored to different user needs, enhancing the value provided by its tax record verification services. Users can choose from basic to premium tiers, benefiting from additional features at each level. Upgrading ensures access to advanced integrations and dedicated support for optimal performance.

Chart boasts a user-friendly interface, designed for seamless interaction and efficient navigation. Its organized layout allows for straightforward access to tax record functionalities, enhancing user experience. Unique features such as structured JSON outputs and real-time tax integration set Chart apart, streamlining document collection processes.

How Chart works

Users interact with Chart by first connecting their IRS or state tax accounts or choosing to upload PDF documents directly. The onboarding process is straightforward and includes a guided consent flow where users select which documents to share. Chart then retrieves verified tax records in real-time, ensuring a hassle-free experience for tech-oriented companies looking to automate tax document collection.

Key Features for Chart

Real-time Tax Record Access

Chart’s real-time tax record access feature allows users to sync and verify tax documents efficiently. By integrating with IRS and state tax agencies, Chart ensures users have immediate access to authentic tax records, streamlining the process of document collection and enhancing accuracy for tech companies.

Verified Document Retrieval

The verified document retrieval feature of Chart guarantees authenticity by sourcing tax returns directly from government databases and reputable tax preparation tools. This unique capability helps users trust the validity of their tax records, enhancing the credibility of automated document collection services provided by Chart.

Enterprise-grade Security

Chart’s enterprise-grade security feature protects user credentials by not persisting them after each session, ensuring maximum privacy. This unique approach, combined with compliance support for major frameworks, reinforces user trust in Chart’s abilities to maintain security while providing seamless tax document collection services.

You may also like: