aVenture

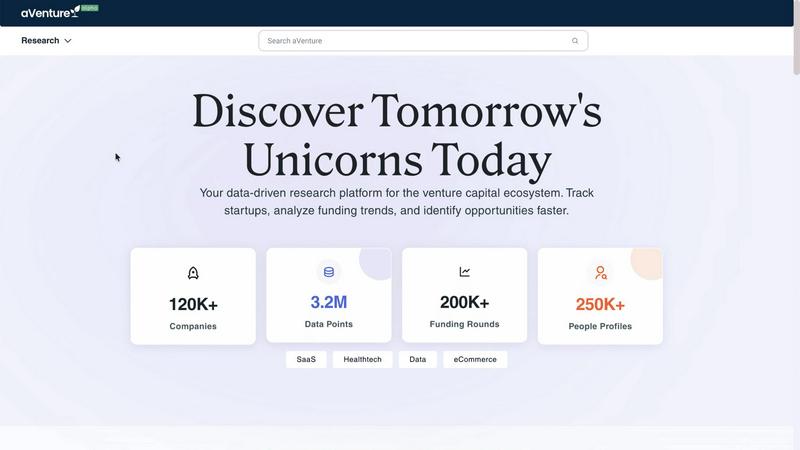

aVenture is an AI platform for institutional-grade research on private companies and venture capital markets.

Visit

About aVenture

aVenture is an institutional-grade venture intelligence platform designed to transform how professionals research private markets. It serves as a comprehensive data engine, tracking over 109,000 active venture-backed companies across 132 countries, aggregating data from more than 1,200 sources to deliver over 12.8 million data points. The platform goes beyond static databases by integrating an AI analyst that reads the latest news and coverage to provide dynamic insights. This AI summarizes a company's traction, highlights potential risks, and explains how new events could impact its future, turning raw data into actionable intelligence. aVenture is built for a diverse user base including venture capitalists conducting due diligence, founders preparing for fundraising rounds, business development teams scouting for partners, and market analysts building competitive landscapes. Its core value proposition lies in delivering precision, context, and efficiency, enabling users to discover opportunities, map ecosystems, track material signals, and collaborate—all within a single, powerful workspace.

Features of aVenture

Deep Company Insights

This feature provides a 360-degree view of any private company within the database. Users can access detailed profiles showing market positioning, funding history, ownership structure, key competitors, and investor lists. It surfaces critical data points that institutional investors rely on, moving beyond basic information to offer a nuanced understanding of a company's strategic standing and financial health within its competitive ecosystem.

AI-Powered Analyst Summaries

aVenture's proprietary AI technology continuously monitors news and public coverage for tracked companies. It then generates concise, insightful summaries that distill lengthy articles into key takeaways about traction, growth signals, emerging risks, and the potential impact of new developments. This feature filters out noise to deliver only material changes, saving users hours of manual reading and analysis.

Advanced Investor Mapping

This tool allows users to deconstruct an investor's portfolio with precision. You can see every company a specific VC firm or angel investor has backed and then apply sophisticated filters by sector, investment stage, geographic location, and deal size. This enables the creation of highly targeted outreach lists for fundraising or partnership discussions, based on proven investment patterns.

Collaborative Workspace Tools

aVenture facilitates team-based research with robust workspace functionality. Users can save custom lists of companies or investors, add private annotations to profiles, export structured data for external reporting, and securely share full research dossiers with colleagues. This turns individual analysis into a collaborative, organized, and repeatable process for entire teams.

Use Cases of aVenture

Venture Capital Due Diligence

VC analysts and partners use aVenture to thoroughly diligence potential investment deals. They can quickly assess a startup's competitive landscape, identify look-alike companies for valuation benchmarking, analyze the track record of existing investors, and use the AI summaries to understand recent news and potential red flags, all accelerating and de-risking the investment decision process.

Founder Fundraising Preparation

Founders preparing for a fundraise leverage aVenture to identify the most relevant investors for their stage, sector, and geography. By studying investors' past deals and portfolio construction, they can tailor their pitch and build a targeted, high-probability outreach list, significantly increasing their efficiency and chances of securing meetings.

Competitive & Market Intelligence

Business development teams and corporate strategists use the platform to scout for potential partners, acquisition targets, or emerging competitive threats. By tracking companies in adjacent markets and monitoring news signals, they can stay ahead of industry shifts and identify strategic opportunities before they become widely known.

Institutional Research & Reporting

Investment firms, limited partners (LPs), and financial institutions use aVenture to build comprehensive market maps and thematic research reports. The ability to export clean data, track funding trends over time, and analyze sector growth supports the creation of data-driven reports on venture capital trends for internal strategy or client-facing materials.

Frequently Asked Questions

What types of companies are included in the aVenture database?

aVenture focuses on venture-backed private companies globally, spanning from early-stage startups to late-stage pre-IPO unicorns. The database of over 109,000 active companies includes firms across all major sectors like SaaS, Fintech, Biotech, and AI, with coverage extending to 132 countries. It tracks companies that have raised institutional funding.

How does the AI analyst differ from a standard news feed?

The AI analyst does not simply aggregate headlines. It actively reads and interprets full articles from a wide range of sources, synthesizing the information to provide a narrative summary. It highlights what specific events mean for a company's growth, points out risks, and connects developments to broader trends, offering context that a raw list of links cannot provide.

Can I track specific themes or sectors, not just individual companies?

Yes, aVenture allows users to follow overarching themes, sectors, or technology trends. You can set up tracking for tags like "Cleantech" or "AI Operations" and receive consolidated updates on relevant funding rounds, company news, and market movements, enabling top-down market analysis alongside bottom-up company research.

Is the data on aVenture reliable and up-to-date?

aVenture aggregates data from over 1,200 sources, including regulatory filings, news publications, and direct sources, to ensure comprehensiveness and reliability. The platform is updated in real-time, with live metrics reflecting the latest counts. The AI analyst further ensures the contextual insights are based on the most recent coverage available.

You may also like:

finban

Plan your liquidity so you can make decisions with confidence: hiring, taxes, projects, investments. Get started quickly, without Excel chaos.

iGPT

iGPT turns messy email data into trusted, context-aware answers for enterprise agents.

Promotron

PromoTron is a cloud-based software that streamlines the promotional industry with e-commerce solutions and automatio...